Unlock the Code to Wealth: Ace Markets CFD Platform Leads a New Journey in Investment

In today's rapidly changing financial markets, choosing an efficient and secure trading platform is crucial to investor success. As a one-stop financial ecosystem built specifically for traders, Ace Markets, with its multi-dimensional core functionality , is becoming the preferred choice for traders from beginners to professionals. The following provides an in-depth analysis of how it empowers users from all backgrounds to achieve their financial goals, focusing on five core dimensions.

Excellent trading experience: comprehensive upgrade from speed to accuracy

For experienced stock traders, trade execution speed is crucial. Ace Markets utilizes institutional-grade infrastructure, delivering sub-millisecond order execution latency, like a "supercar on the highway," ensuring precise capture of opportunities even in the most volatile price fluctuations. With floating spreads as low as 0.1 pips and one-click execution, high-frequency traders face significant cost pressures. New traders can use a demo account to familiarize themselves with the market without risk. The platform's built-in "Trade Replay" tool acts like a "financial video recorder," helping them review the gains and losses of every trade.

Fund security: triple protection system builds the cornerstone of trust

Ace Markets addresses the primary concern of financial analysts regarding fund security with bank-grade encryption (SSL 256-bit) and a segregated account system. Client funds are held in segregated accounts at top-tier partner banks, completely separate from the platform's operating funds, effectively "bulletproofing" their assets. Furthermore, Ace Markets Limited, the platform's parent company, holds a regulatory registration (Registration Number: 16042) and undergoes regular third-party audits, ensuring traceability of every transaction. For tech enthusiasts, biometric login (such as fingerprint/facial recognition) further elevates security into the intelligent era.

Smart Market Analysis: Data-Driven Decision Support

Whether it's gold, forex, or stock index futures, the platform's integrated AI analytics engine scans data streams from over 20 global exchanges in real time. Its unique "heat map dashboard" transforms complex market sentiment into red and green gradients, allowing even novice traders to intuitively identify capital flows. Experienced users can access the Deep Liquidity Index (DOM) for an X-ray-like view of major traders within the order book. The free and accessible weekly Institutional Holdings Report reveals real-world changes in hedge funds' positions, providing guidance for strategic adjustments.

24/7 Technical Support: From Troubleshooting to Educational Empowerment

When market volatility triggers system lags, most platforms require email queues. Ace Markets' "three-minute response promise" resolves issues through a triple channel of live customer service, a dedicated phone line, and remote desktop collaboration—like a trading terminal equipped with an "emergency doctor." Its knowledge base includes over 300 hours of video courses, ranging from basic candlestick chart interpretation to quantitative strategy development, and intelligently pushes content based on user experience. For example, financial analysts receive an API development guide, while novice investors receive a "vernacular dictionary" that explains the principle of leverage using the analogy of "buying cabbage."

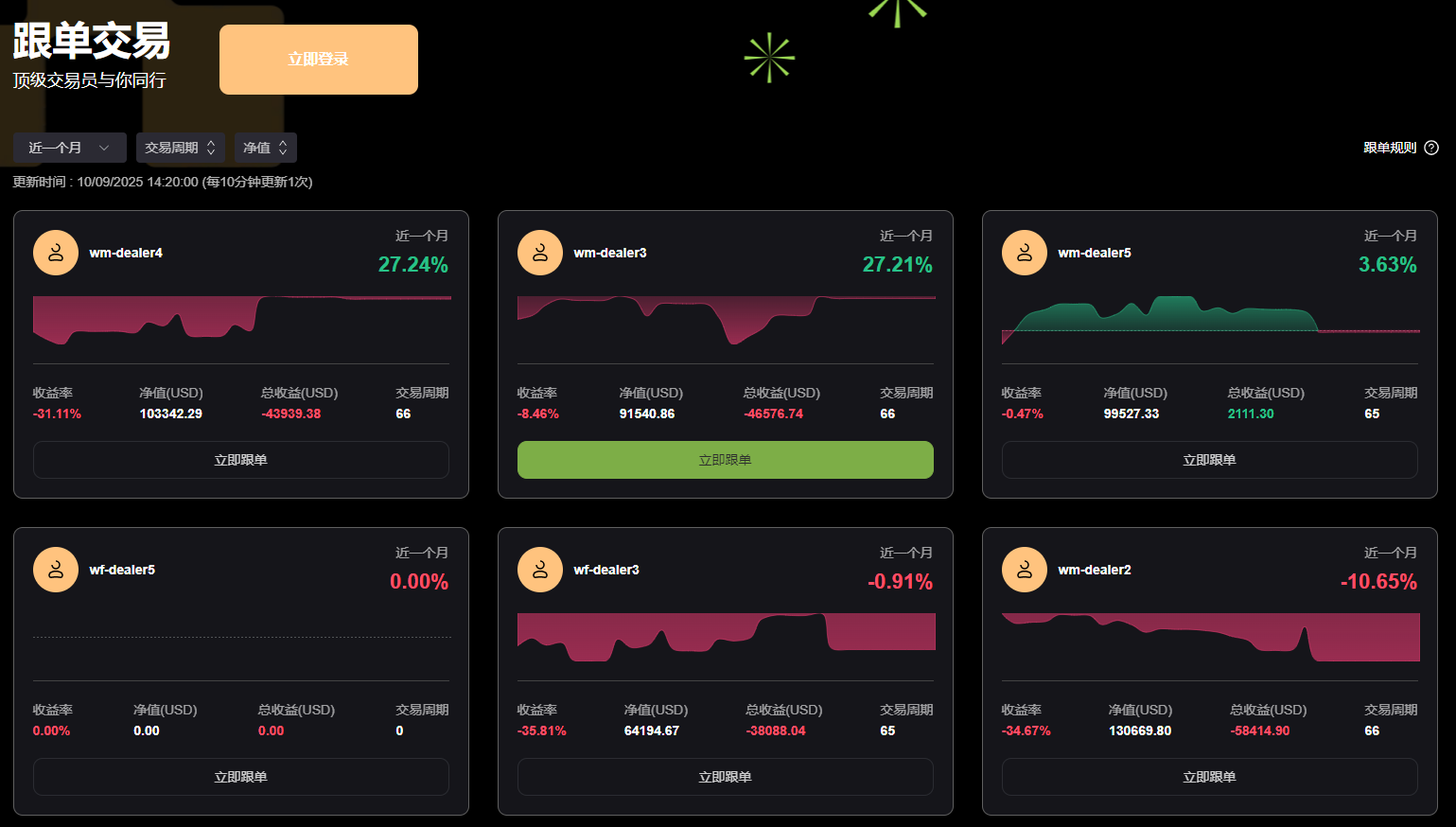

Wealth Growth Ecosystem: From Solo Competition to Collaborative Evolution

The platform's unique "Strategy Workshop" allows users to upload trading models and backtest them against historical data. Top performers are selected for inclusion in the "Strategy Supermarket." Other users pay to subscribe, and the creators receive a commission—creating a closed loop for "knowledge monetization." For long-term investors, the smart fixed investment tool supports automatic rebalancing across asset portfolios. For example, by setting a 60/40 stock-bond ratio, the system will automatically maintain risk exposure like an "autopilot." The social copy trading feature allows new traders to replicate the moves of top traders in real time, reducing the learning curve.

From lightning-fast order execution to rigorous risk control systems, from data visualization to user-friendly service, Ace Markets is redefining the value of a trading platform. Whether you're a casual office worker using your phone or a seasoned algorithmic trading expert, there's a tool here to transform the chaos of the financial markets into a clear path to wealth. As its brand philosophy states: "We don't predict the market; we empower traders."

The content of this article is spontaneously contributed by Internet users, and the views expressed in this article only represent the author himself. This website only provides information storage space services, does not own ownership, and does not assume relevant legal responsibilities.https://www.aneimedzi.cn/html/124.html