A major asset reshuffle has begun amidst devaluation. Is trust in fiat currencies collapsing? Gold becomes the new safe haven!

Global financial markets are experiencing severe volatility: the precious metals sector continues to strengthen, with gold and silver prices hitting new highs; at the same time, sovereign debt and fiat currency credit have suffered setbacks, and funds have accelerated to safe-haven assets such as precious metals and cryptocurrencies. The "depreciation trade" of long-term repricing of multiple assets has already begun.

Market appearance: precious metals lead the rally and global financial shock

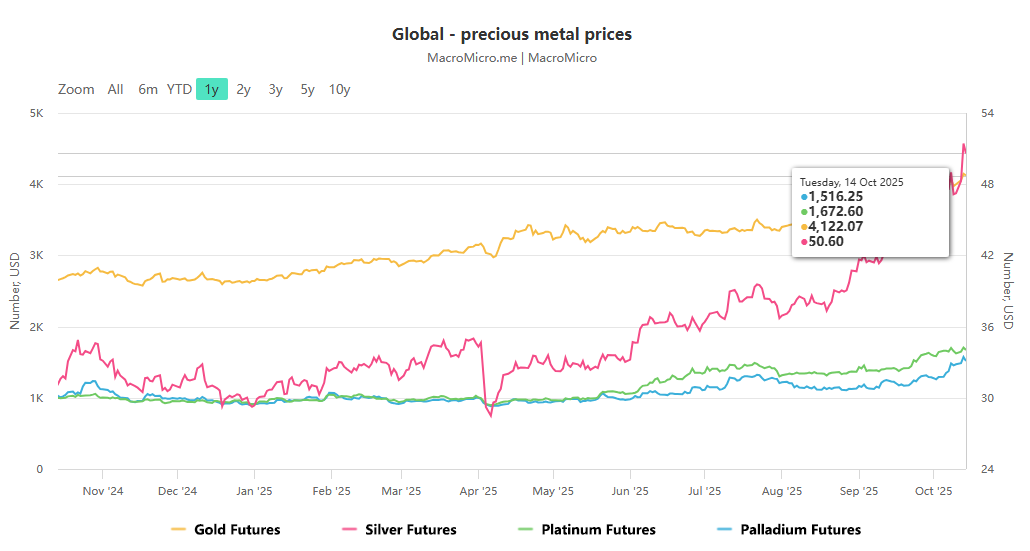

The recent surge in precious metals prices has been a market focal point. As of Wednesday, spot gold hit $4,160 per ounce for the first time, a daily gain of over 1%, bringing its year-to-date gain to over $1,500. Silver's performance was even more dramatic, driven by a historic short squeeze in the London market. As of the time of writing, it had surged by over 3.3% to $51.63 per ounce, surpassing the $53 per ounce mark to reach a new all-time high. Platinum and palladium also saw significant gains, ushering in a full-scale bull market for the precious metals sector.

The strength of precious metals isn't an isolated phenomenon; global financial markets are experiencing a simultaneous turmoil. Trump's social media posts have wiped out $2 trillion in US stock market value, with the S&P 500 index plummeting 2.7% in a single day, its worst performance since early April. At the open on Monday, New York copper futures rose over 2%, while WTI and Brent crude oil climbed nearly 3%. US stock index futures rebounded, with Nasdaq futures rising over 1%. Bitcoin briefly surged nearly $1,000 (up over 20% year-to-date). Meanwhile, safe-haven assets like the Japanese yen weakened, while the US dollar bucked the trend and rose, but remains in a year-to-date decline. This simultaneous recovery in risk and safe-haven assets reflects a market reassessment of traditional asset logic.

Short-term catalyst: resonance between short squeeze and policy disturbance

This round of market volatility is driven by a combination of supply-demand imbalances and policy uncertainty. A sharp decline in London silver inventories has sparked expectations of a short squeeze. Coupled with the impending US "Section 232" investigation into critical minerals (including silver and platinum), supply pressure has increased sharply, leading to a surge in industrial precious metals prices.

On the policy front, Trump's actions continue to impact the market. After the April tariff crisis, the S&P 500 index rebounded to a high, riding on the AI boom and expectations of a Fed rate cut. However, its high valuation makes it vulnerable to risk. Trump has repeatedly pressured the Fed to cut rates and attempted to fire Governor Lisa Cook. His intervention in monetary policy and challenges to the central bank's independence have severely undermined market confidence in the US dollar and US Treasuries, becoming a key factor in the short-term surge in precious metals prices.

Long-term core: debt distress, central bank confidence crisis, and the fall from favor of fiat currencies

The continued strength of precious metals is essentially the resonance of long-term trends and short-term events. The core contradiction points to the global debt crisis and the decline in confidence in legal tender.

Debt and Fiscal Risks: Japan, the US, and Western Europe face a triple-digit debt burden, facing a "triple whammy." Debt servicing costs may remain flat in 2030, making spending cuts and tax increases difficult to implement. US deficits are high, prompting Trump to push for rate cuts. Tariffs and a shutdown could weigh on the dollar and benefit gold. Japan's high market continues to stimulate demand, while a slowdown in central bank rate hikes could lead to higher inflation. Europe faces a budget impasse in France and populism, prompting criticism from British political parties of the central bank and risks for gilts.

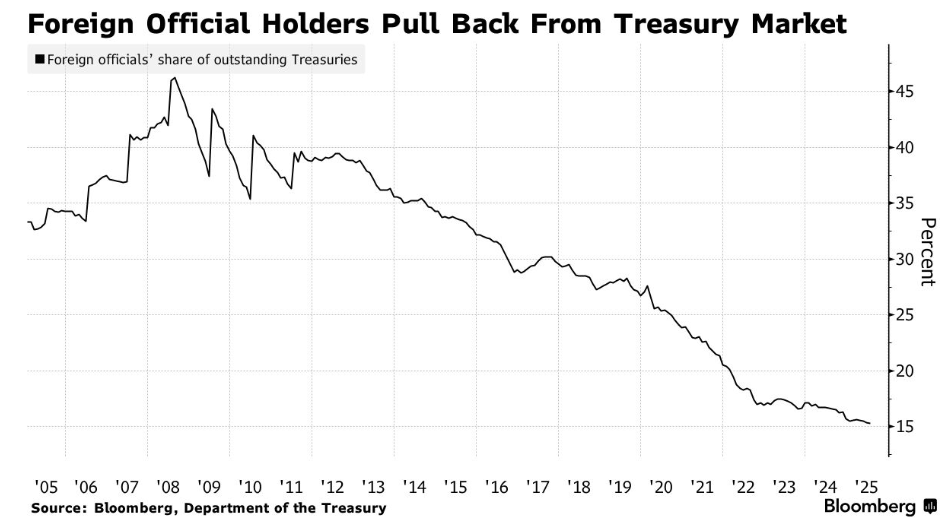

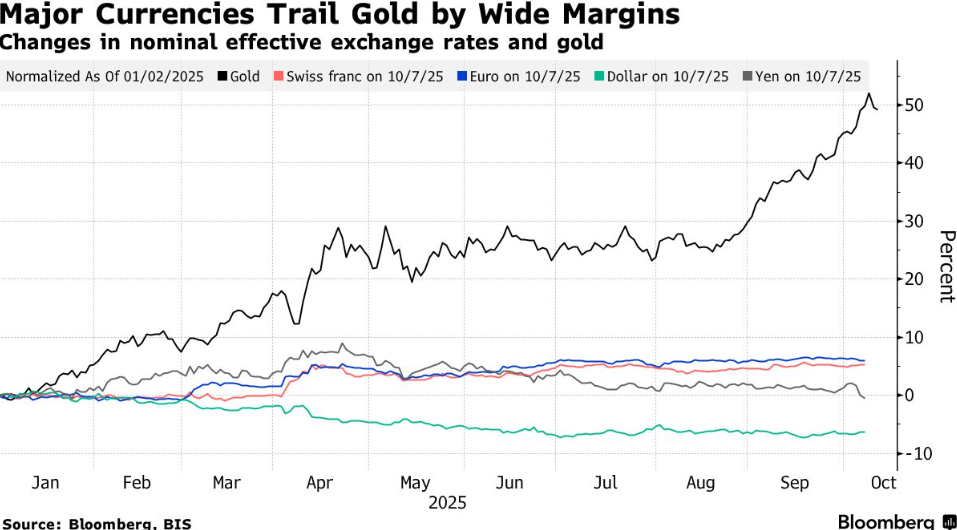

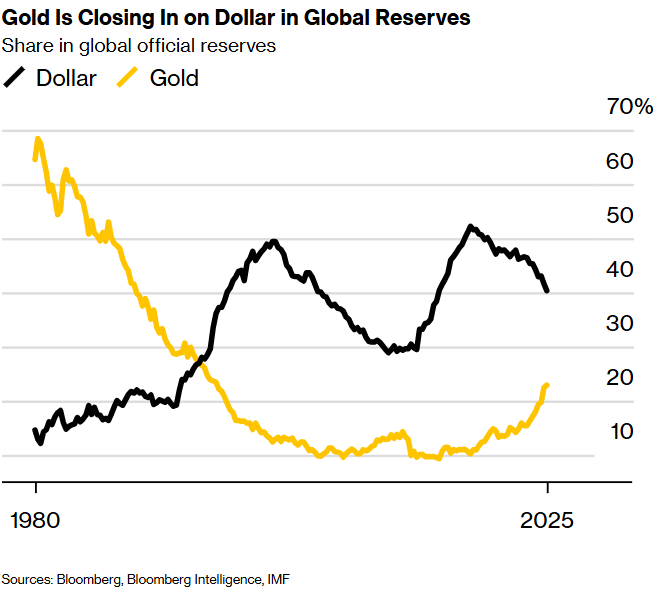

Currency Confidence Crisis: Amidst a crisis of confidence in fiat currencies, gold has replaced the US dollar as a safe haven. Gold's safe-haven value has intensified, with central banks selling US Treasuries and increasing their gold reserves, accelerating the de-dollarization movement.

Devaluation Trading and Assets: Confidence in currencies and sovereign debt has declined, and the emergence of "devaluation trading" has shifted funds from traditional assets to precious metals and cryptocurrencies. Ray Dalio and others are bullish on gold and skeptical of US Treasuries, while Taleb warns of a US debt crisis.

Institutional Outlook: Balancing Short-Term Fluctuations with a Long-Term Bull Market

Faced with the current market structure, institutions have different judgments on short-term and long-term trends, but the logic revolves around "short-term emotional disturbance" and "long-term trend remains unchanged."

Short term: Adjustment risks and rebound opportunities coexist

The US stock market has been plagued by excessive greed this summer, and complacency could put pressure on investors, potentially leading to a sell-off that could escalate into a large-scale correction. The S&P 500's technical outlook is troubling. The decline to 6552.51 last Friday weakened market breadth and momentum, potentially triggering an autumn sell-off. Cross-asset volatility is already evident. Despite October's market turmoil, if the economy doesn't suffer a significant blow, a year-end rebound is expected, potentially validating a buy-on-the-dip strategy. While global supply chains face risks, there's still room for compromise, and Trump faces political risks if he carries out his threats.

Long term: Gold bull market foundation is solid

Judging from gold's technical analysis and long-term outlook, the bull market fundamentals remain intact. Gold's primary trend remains upward, and with the price currently at record highs, traditional resistance levels have failed. Psychological round numbers like $4,200 will become the next upward targets. Bank of America's Michael Hartnett offers a more optimistic forecast: "While history is not predictive of the future, the past four gold bull markets have averaged a 300% increase within 43 months, suggesting that gold prices could reach $6,000 per ounce by next spring."

The situation is changing, and the safe-haven king's status continues to consolidate

The current market dynamics stem from the convergence of short-term events and long-term trends. Despite reassurances from multiple parties and institutional bullishness on risky assets, gold's rally remains resilient. Against the backdrop of lingering trust in fiat currencies and persistent debt and geopolitical risks, gold's safe-haven status will continue to strengthen. A global asset repricing driven by "depreciation trades" may become the dominant market trend. This precious metals rally has become a microcosm of the global financial system's reshaping of trust and value.

The content of this article is spontaneously contributed by Internet users, and the views expressed in this article only represent the author himself. This website only provides information storage space services, does not own ownership, and does not assume relevant legal responsibilities.https://www.aneimedzi.cn/html/221.html