The Double Game in the US Financial Market : The Deep Intertwining of the "Devaluation Trading" Controversy and Liquidity Policy Adjustments

The current U.S. financial market is at the intersection of a set of key contradictions: on the one hand, there is heated discussion about the "dollar devaluation trade" triggered by the surge in "hard assets" such as gold and cryptocurrencies, and on the other hand, there is direct counter-evidence from the stable performance of the U.S. dollar and U.S. Treasury bond markets; at the same time, the U.S. banking system reserves fell below the critical threshold of 3 trillion U.S. dollars, and the Federal Reserve released a signal that quantitative tightening may end in the next few months, further tying asset price disputes to changes in the liquidity environment, forming a complex market pattern that influences and serves as clues to each other.

1. The Appearance and Counter-evidence of “Depreciation Trading”: Asset Differentiation under Liquidity Expectations

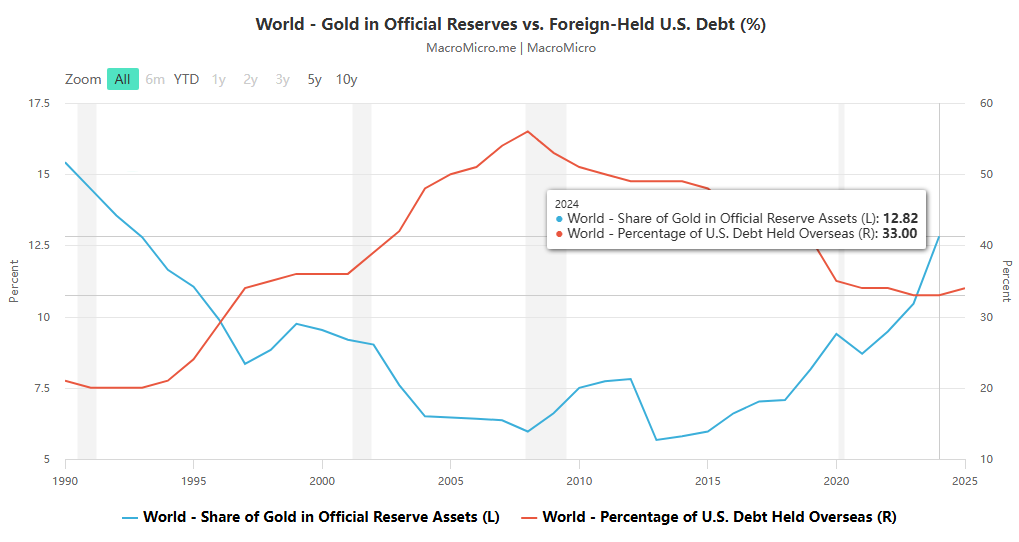

Since JPMorgan Chase introduced the "depreciation trade" at the beginning of the year, it has been based on the core logic that "inflation erodes the purchasing power of the US dollar." It is closely linked to the direction of the Federal Reserve's liquidity policy, influencing investor asset allocation. On the surface, gold prices have soared 50% this year, with precious metals and the $4 trillion cryptocurrency market surging in tandem. This is seen as a hedge against the "dollar depreciation and inflation risks." This trend is driven by the long-term pressure of rising US government debt and the Fed's decision to cut interest rates after six years of inflation exceeding its 2% target. These rate cuts also need to consider liquidity conditions amidst declining bank reserves to avoid overly tightening the financial environment.

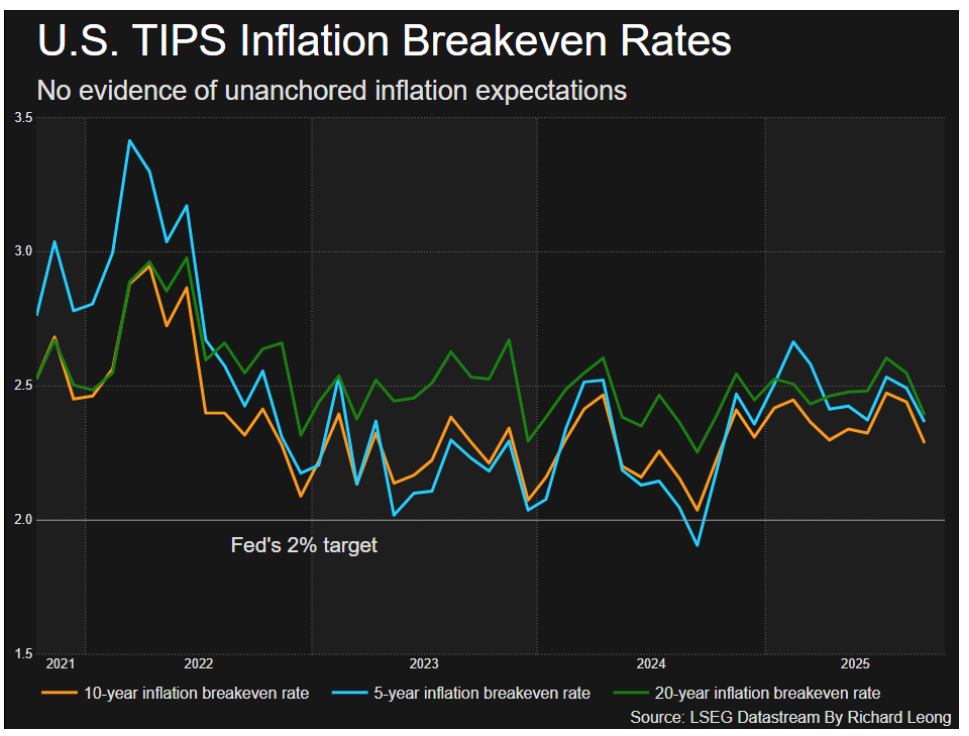

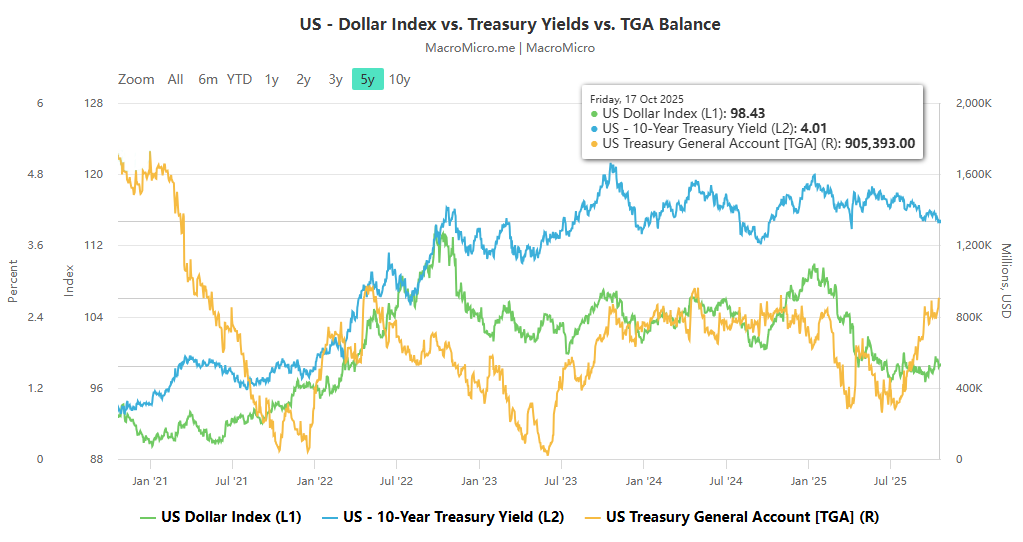

The actual market performance contradicts the logic of selling Treasury bonds due to depreciation concerns and is closely tied to liquidity dynamics. In the bond market, the nominal yield on the 10-year Treasury bond fell below 4% last week (hitting an April low), bringing its year-to-date decline to nearly 60 basis points; the 30-year yield also fell by about 20 basis points. Lower inflation expectations (the break-even inflation rates for both 10-year and 30-year Treasury Notes (TIPS) hit multi-month lows), coupled with expectations of a slower Fed balance sheet reduction and the possible end of QT, have reduced liquidity risks in Treasury bonds and weakened investors' incentive to sell.

The US dollar's exchange rate performance strongly refutes the "depreciation trade" argument. The US dollar started the first half of 2025 weakly, but has stabilized significantly since April. Last week, the US dollar index closed at its six-month average, and has been strong among G10 currencies for nearly a month. Jane Foley of Rabobank noted that if the US dollar depreciated across the board, funds would flow from the US dollar and US Treasuries to gold, but the market has shown no such signs. This is due to the Federal Reserve's cautious balance sheet reduction, which has encouraged investors to maintain their US stock holdings (with 80% of their portfolios hedged against exchange rates) while also allocating to gold to hedge risk, forming a balanced strategy of "holding US Treasuries and increasing gold holdings."

II. Key Shifts in Liquidity Policy: Market Transmission of Expectations of Reserve Requirement Breakdown and the End of Balance Sheet Shrinkage

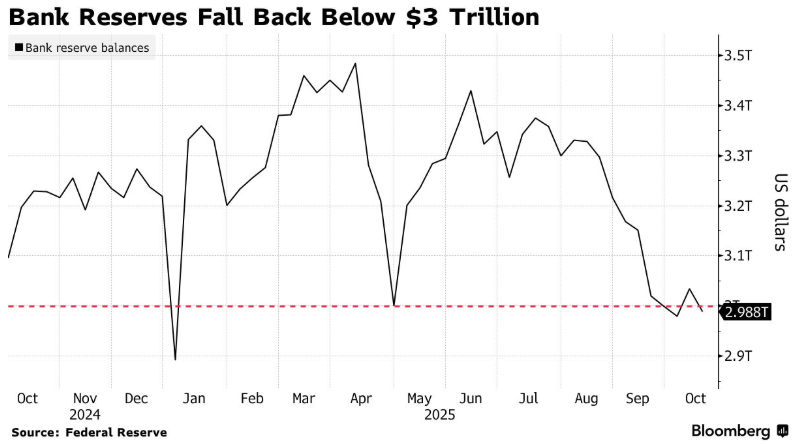

As a core indicator of the Federal Reserve's liquidity management, U.S. bank reserves are crucial for resolving the "devaluation trade" dilemma. In the week of October 15th, bank reserves fell to $2.99 trillion, below the $3 trillion mark, a decrease of $45.7 billion from the previous week. This break was driven by the accelerated issuance of bonds to rebuild cash balances following the July debt ceiling increase. This not only depleted reserves and pushed the limits of overnight reverse repos, but also led to a faster decline in foreign banks' cash assets. This also highlighted cross-border impacts, directly prompting the Federal Reserve to signal the end of its balance sheet reduction, which in turn affected the price linkage between the dollar, U.S. Treasuries, and "hard assets."

With reserves approaching the "ample lower bound," the Federal Reserve signaled a policy shift. Powell stated that the QT period will end when reserves rise slightly above the minimum level for market stability, a point likely to occur "in the coming months." Waller noted that the current reserve level of $2.99 trillion is close to his estimated minimum threshold of $2.7 trillion. The Fed had already slowed the pace of balance sheet reduction at the beginning of the year, and this announcement suggests the countdown has begun. This expectation stabilized the Treasury market, pushing yields downward, contradicting the "downdraft trade" expectation of a "yield surge."

Liquidity changes influence market perceptions of depreciation through interest rate channels. Last week, the effective federal funds rate edged up slightly within the 4%-4.25% range, with the 75th percentile rate rising from 4.10% to 4.12%, indicating a tightening financing environment. However, anticipation of an imminent end to balance sheet reduction has led the market to believe that liquidity will not shrink excessively, leading to the dollar's stabilization rather than depreciation. This also explains the coexistence of a "rise in hard assets" and a "stable dollar and US Treasury bond market": investors are using hard assets to hedge against inflation, while also remaining cautious about the risk of short-term dollar depreciation due to a shift in liquidity policy.

III. The Nature of the Market Under the Double Game: The Collision of Simplified Narratives and Complex Realities

The core contradiction in the current financial market lies in the clash between the simplistic narrative of the "devaluation trade" and the complex realities of "liquidity, assets, and policy." The "devaluation trade" uses a single logic to determine asset prices, but ignores the way the Federal Reserve's liquidity policies influence market expectations. The expectation of an end to balance sheet reduction, triggered by a drop in reserve requirements, mitigates U.S. Treasury liquidity risks while also stabilizing dollar fluctuations and curbing the extreme market trend of "selling dollars and Treasury bonds in favor of hard assets."

The Federal Reserve's liquidity policy adjustments are also mired in the dilemma of "depreciation concerns." The slowdown in balance sheet reduction aims to stabilize the banking system and, in the context of subpar inflation, avoid exacerbating market anxiety over a "recession and currency depreciation" scenario caused by tightening liquidity. This policy balance has led to a rare simultaneous rise in both hard assets and traditional assets.

The complexity of the US financial market defies a single logic. The rise in gold and cryptocurrencies reflects long-term inflation and debt risks; the stability of the US dollar and US Treasuries benefits from the support provided by the Federal Reserve's liquidity policies. Future trends hinge on the interplay between the "downtrade" and liquidity policies. An unexpected decline in inflation will weaken the "downtrade," while an accelerated decline in reserves could prompt the Fed to prematurely end its balance sheet reduction and stabilize traditional assets. Therefore, only by comprehensively considering the linkage between liquidity policies and asset prices can we accurately predict market trends.

The content of this article is spontaneously contributed by Internet users, and the views expressed in this article only represent the author himself. This website only provides information storage space services, does not own ownership, and does not assume relevant legal responsibilities.https://www.aneimedzi.cn/html/242.html