Gold Targets $6,000? The Investment Logic Behind Bank of America's Aggressive Forecast!

Precious metals market hits record high

On Monday morning, spot gold achieved a historic moment, breaking through the $5,000/ounce mark for the first time. This price level comes just over 100 days after it first reached the $4,000 mark (October 8, 2025). As of press time, spot gold was trading at $5,086.50/ounce, a daily gain of over 2%. Looking at the 15-minute chart, spot gold opened at $5,075.04/ounce, reached a high of $5,088.94/ounce, a low of $5,072.57/ounce, and finally closed at $5,087.17/ounce.

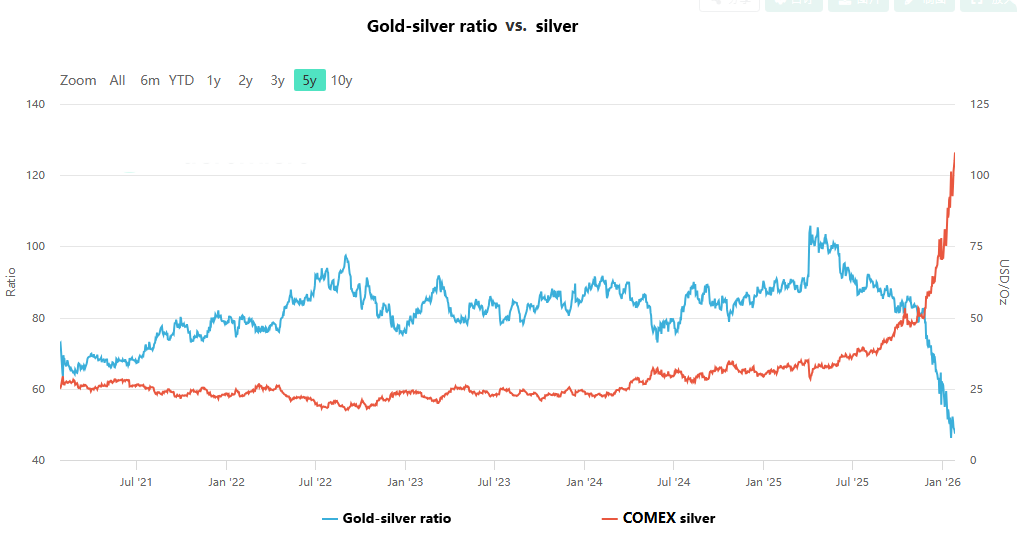

Meanwhile, spot silver also surged, breaking through $108/ounce for the first time, with a daily gain exceeding 5%. 15-minute chart data shows spot silver opened at $107.998/ounce, reaching a high of $108.459/ounce and a low of $107.971/ounce, ultimately closing at $108.398/ounce. Amidst this bullish precious metals market, other markets showed mixed performance. US stock futures weakened, with Nasdaq futures falling as much as 1.1% in early trading on Monday, and S&P 500 futures down 0.75%. US natural gas futures rose 16% due to the Arctic cold front.

The core driving factors for the rise in precious metal prices

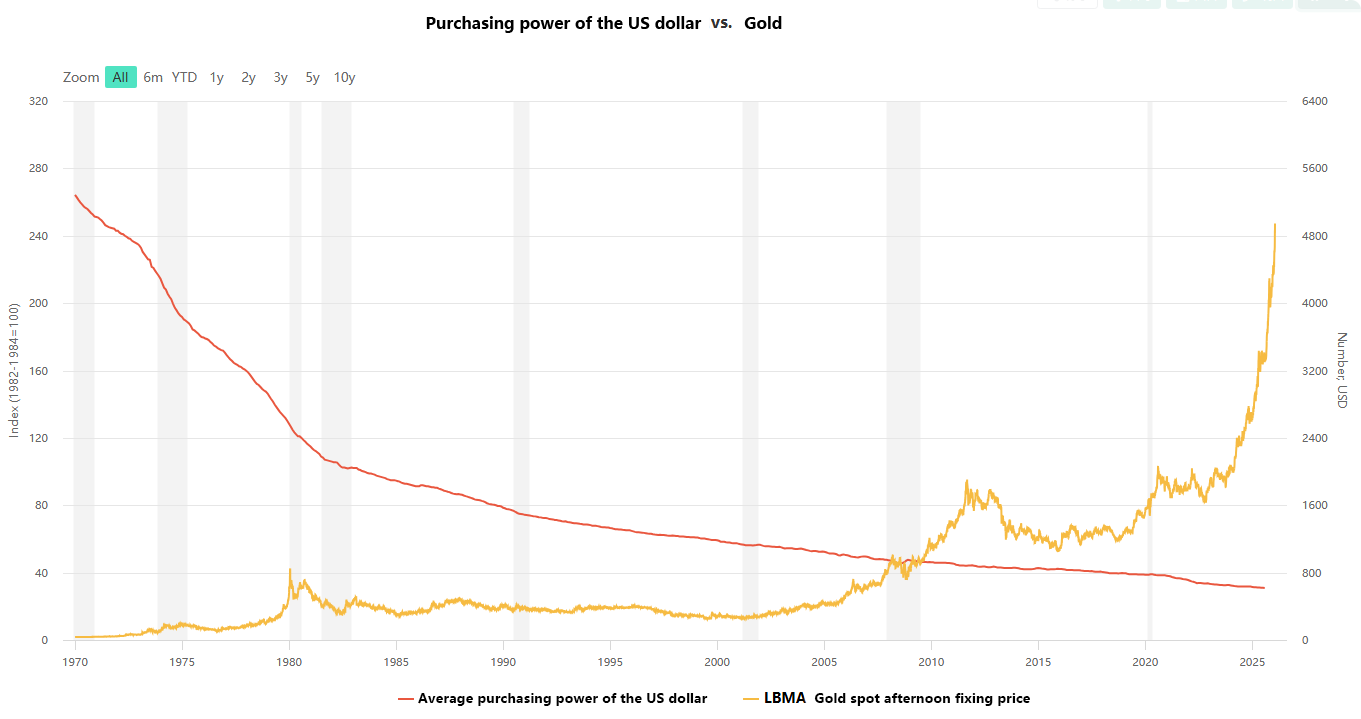

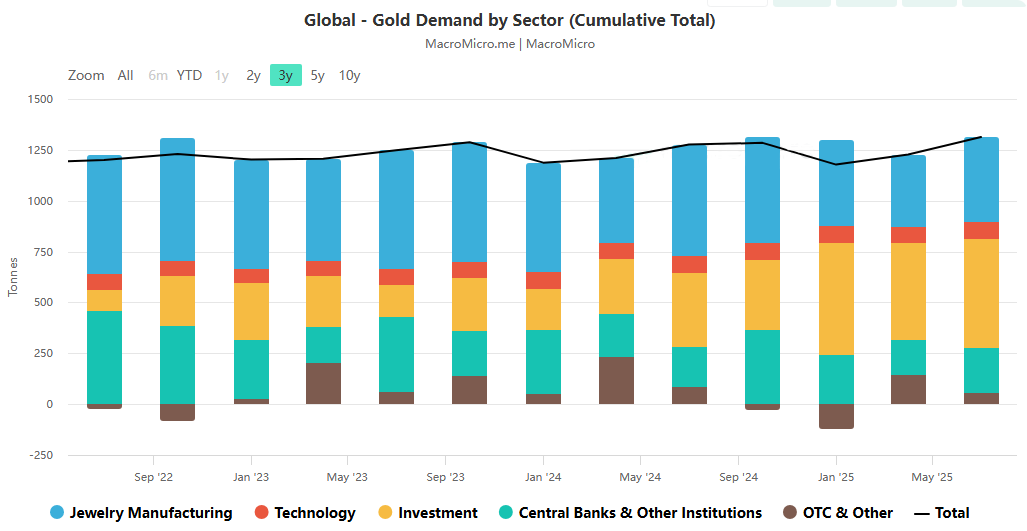

Central banks' increased gold purchases, escalating global geopolitical tensions, and economic uncertainty are the core macroeconomic factors driving up precious metal prices in recent years. These factors have collectively enhanced the safe-haven appeal of gold and silver, attracting a large influx of funds. Colin Cieszynski, chief market strategist at SIA Wealth Management, also pointed out that the continued weakening of the US dollar may be the biggest driver of gold's rise. Chris Vecchio, head of futures strategy and foreign exchange at Tastylive.com, stated that the dollar's credibility has been shaken and it is no longer the absolute first choice for investors.

Strong market demand for assets not bound by the fiat currency system is driving investors toward alternative physical assets like gold and silver. Silver price increases are also attributed to a unique supply and demand dynamic. The development of green technologies such as solar energy and electric vehicles, as well as artificial intelligence, continues to boost industrial demand for silver. Simultaneously, the silver market faces a structural supply deficit, and the supply shortage is difficult to alleviate effectively, further pushing prices upward.

Industry analysts' assessment of short-term trends in precious metals

The latest Kitco News weekly gold survey shows that Wall Street is extremely bullish on gold's near-term outlook, while retail investors' bullish bias has diminished. Bullish analysts believe gold still has room to rise in the short term. Rich Checkan, president and COO of Asset Strategies International, stated that geopolitical tensions, concerns about the Federal Reserve's political influence, and worries about stock valuations and commodity momentum will all drive gold prices higher, with no pullback expected in the short term. James Stanley, senior market strategist at Forex.com, pointed out that the $5,000 level may slow the pace of gold's rise, or even trigger a slight pullback, but there is no evidence that buyers have exited the market. Gold's reaction to the $4,900 level during the pullback demonstrates that it still has room to rise.

Neutral analysts believe the medium- to long-term trend for gold is positive, though short-term volatility is possible. Colin Cieszynski, Chief Market Strategist at SIA Wealth Management, holds a neutral stance, expecting the driving factors for gold's medium- to long-term rise to persist, with short-term factors such as developments in Greenland providing additional impetus. Regarding the silver market, most analysts are optimistic about its short-term upward momentum, while also warning of high volatility risks. Paul Williams, Managing Director at Solomon Global, points out that silver's upward momentum will be supported by multiple factors, including growing industry demand, increased retail investment interest, enhanced safe-haven appeal, and a widening supply deficit. Due to high gold prices, silver has become a convenient way for general investors to participate in the precious metals bull market.

However, the high volatility of silver warrants caution. Paul Williams stated that silver prices can fluctuate by up to 10% daily, and the higher the price, the greater the volatility is likely to be; profit-taking will diminish its appeal. Chris Vecchio and Michele Schneider, chief market strategist at MarketGauge, have both closed out some of their silver positions to mitigate volatility risk. Chris Vecchio also pointed out that the one-week moving average of $95/ounce is an important level to watch; as long as silver can maintain above $85/ounce by the end of January, the overall upward trend will be relatively stable.

Bank of America raised its gold price target to $6,000.

Just as the market was celebrating gold prices breaking through $5,000, Bank of America released an aggressive forecast, raising its near-term target price for gold to $6,000 per ounce, a level far exceeding the expectations of other major institutions. Bank of America analyst Michael Hartnett stated in a report that in the past four gold bull markets, gold prices have risen by an average of 300% over 43 months. This rule suggests that gold prices are expected to reach $6,000 per ounce in the spring of 2026, representing a further increase of over 20% from the current all-time high.

According to Michael Widmer, head of metals research at Bank of America, gold will remain a key allocation in investors' portfolios in 2026. His assessment is based on predictions of declining supply and rising costs in the gold industry. He expects the 13 major North American gold miners to produce 19.2 million ounces of gold in 2026, a 2% decrease from 2025. At the same time, the average total sustaining cost for gold mines is expected to rise by 3% to approximately $1,600 per ounce. With rising costs and higher prices, gold miners' total EBITDA is projected to grow by 41% in 2026, reaching approximately $65 billion.

Regarding silver's long-term potential, Michael Weider believes it's better suited for investors willing to take on higher risks for higher returns. The current gold-silver ratio of around 59 suggests silver still has the potential to outperform gold. He cites historical data, noting that the gold-silver ratio fell as low as 32 in 2011, which, if extrapolated, would have allowed silver to reach a high of $135 per ounce; in 1980, the ratio even dropped to 14, corresponding to a silver price potentially reaching $309 per ounce.

Core Recommendations for Precious Metal Investment Allocation

From an asset allocation perspective, there is still significant room for improvement in gold allocation. Michael Widmer points out that while gold accounts for approximately 4% of the total financial market, high-net-worth investors in the professional investment field allocate only 0.5% of their assets to gold. Data analysis suggests that, given the market conditions since 2020, retail investors' gold allocation should be far higher than 20%, and the current 30% allocation is reasonable. Central banks around the world can also benefit from gold allocations.

Michael Widmer predicts that even if central banks' gold reserves reach a milestone in 2025, their gold purchases will not stop. Currently, gold accounts for an average of 15% of total central bank reserves, and model calculations show that this proportion would be around 30% for central bank reserve allocation to be fully optimized. Both central bank portfolios and institutional portfolios can improve stability through gold allocation diversification strategies.

Regarding the key factors influencing precious metal prices, Michael Widmer emphasizes that the end of a gold bull market often occurs after the initial fundamental drivers of the rise fade, not simply due to price increases. He believes that US monetary policy will be a key factor affecting gold prices in 2026. Models show that during periods of loose monetary policy, when inflation is above 2%, gold prices rise by an average of 13%. The market doesn't even need to see the Federal Reserve announce rate cuts at every meeting; simply confirming that interest rates are on a downward trend is enough to support higher gold prices.

The content of this article is spontaneously contributed by Internet users, and the views expressed in this article only represent the author himself. This website only provides information storage space services, does not own ownership, and does not assume relevant legal responsibilities.https://www.aneimedzi.cn/html/334.html